The Canada laparoscopy devices market is expected to be driven by growing technological innovations in the field of laparoscopy, the growing burden of chronic diseases, and the rising preference for minimally invasive procedures.

The Canada laparoscopy devices market was valued at $392.1 million in 2021 and is anticipated to reach $865.6 million by 2031, witnessing a CAGR of 7.31% during the forecast period 2022–2031. The market is driven by factors such as the rising preference for minimally invasive surgeries, growing geriatric population, rising bariatric population, and rising approval for robotic surgical systems.

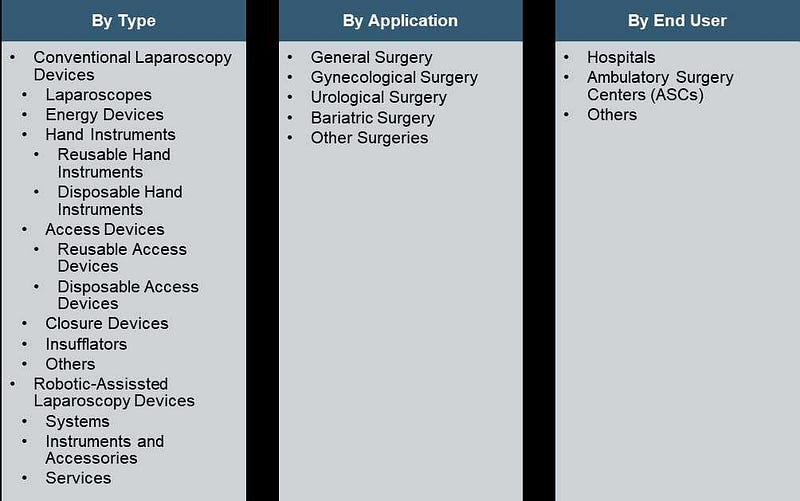

Canada Laparoscopy Devices Market Segmentation

Impact of COVID-19

The COVID-19 pandemic has impacted practically all sectors and social functions worldwide, including the Canada laparoscopy devices market. COVID-19 led to a decline in the Canada laparoscopy devices market, as elective and surgical procedures were stopped during the lockdown.

Overall, the supply side was negatively impacted, especially during the peak of the COVID-19 pandemic. The significantly high number of laparoscopic procedures resumed after the restrictions were lifted, which offset the negative impact and led to the growth of the market in 2021.

In addition to this, the COVID-19 pandemic also helped in the adoption of disposable laparoscopy devices. Single-use laparoscopy devices eliminate the risk of cross-contamination, which turned out to be a favorable condition for their adoption during the COVID-19 pandemic.

Recent Developments in the Canada Laparoscopy Devices Market

• In June 2022, Ethicon, Inc., a subsidiary of Johnson & Johnson, launched the next-gen Echelon 3000 stapler, a closure device for surgical procedures.

• In April 2022, Ethicon, Inc., a subsidiary of Johnson & Johnson, launched Enseal X1 Straight Jaw Tissue Sealer, a closure device for stronger sealing in several surgical procedures.

• In December 2021, Medtronic plc received a Health Canada license for its Hugo RAS system for the expansion of robotic-assisted surgery.

• In December 2021, Intuitive Surgical Inc. received approval from the U.S. FDA for its 8 mm SureForm 30 curved-tip stapler (closure device).

• In July 2019, Intuitive Surgical, Inc. acquired the robotic endoscope business of Schölly Fiberoptic. Through this acquisition, the company gained access to Schölly’s robotic endoscope manufacturing line.

Demand — Drivers and Limitations

Following are the drivers for the Canada laparoscopy devices market:

• Rising Preference for Minimally Invasive Procedures

• Rising Regulatory Approvals for Robotic Systems

• Growing Geriatric Population

• Rising Bariatric Surgeries

The market is expected to face some limitations as well due to the following challenges:

• Long Waiting Time for Laparoscopic Procedures

• High Cost of Robotic-Assisted Surgery Systems

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analyzing company coverage, product portfolio, and market penetration.

Some of the players in this market are:

• Applied Medical Resources Corporation

• Arthrex, Inc.

• B. Braun SE

• Becton, Dickinson and Company

• Boston Scientific Corporation

• Cook Group

• CONMED Corporation

• EIZO Corporation

• Intuitive Surgical, Inc.

• Johnson & Johnson

• KARL STORZ SE & Co. KG

• Medtronic plc

• Olympus Corporation

• Smith & Nephew plc

• Stryker Corporation

• Teleflex Incorporated

Get Free Sample Report — https://bisresearch.com/requestsample?id=1390&type=download

How can this report add value to an organization?

Type: The type segment helps the reader understand the different types of laparoscopy products available in the market. Moreover, the study provides the reader with a detailed understanding of products that fall under the two main segments, i.e., conventional laparoscopy devices and robotic assisted laparoscopy devices.

Growth/Marketing Strategy: The Canada laparoscopy devices market has witnessed major development by key players operating in the market, such as product launches, business expansions, partnerships, collaborations, and regulatory and legal approvals. The favored strategy for the companies has been regulatory and legal activities and new offerings to strengthen their position in the market. For instance, in June 2022, Ethicon, Inc., a subsidiary of Johnson & Johnson, launched the next-gen Echelon 3000 stapler, a closure device for surgical procedures, and in December 2021, Medtronic plc received a Health Canada license for its Hugo RAS system for the expansion of robotic-assisted surgery.

Competitive Strategy: The key players in the Canada laparoscopy devices market analyzed and profiled in the study involve established and emerging players that offer different products for laparoscopic procedures. Moreover, a detailed competitive benchmarking of the players operating in the Canada laparoscopy devices market has been done to help the reader understand the ways in which players stack against each other, presenting a clear market landscape. Moreover, comprehensive competitive strategies such as partnerships, agreements, collaborations, mergers, and acquisitions will help the reader understand the untapped revenue pockets in the market.

BIS Related Studies

Middle East and North Africa Laparoscopy Devices Market — A Regional Analysis

Laparoscopy and Endoscopy Devices Market — A Global and Regional Analysis

Article source: https://article-realm.com/article/Finance/34393-Canada-Laparoscopy-Devices-Market-Top-Companies-Trends-Growth-Factors-Details-by-2031.html

Reviews

Comments

Most Recent Articles

- Nov 4, 2024 How Can Mutual Fund Software Help MFDs Find Common Stocks Between Two Schemes? by Wealth Elite

- Oct 28, 2024 What Are the Best Features of a Mutual Fund Software in India? by Wealth Elite

- Oct 23, 2024 Why Women Investors Need a Financial Planning Consultant in Mumbai? by Chamunda Investment Services LLP

- Oct 21, 2024 How Does Mutual Fund Software Help in Planning Education Investments for Investors? by Wealth Elite

- Oct 11, 2024 How Does Mutual Fund Software in India Help in Planning Regular Income with SWP Calculator? by Wealth Elite

Most Viewed Articles

- 11257 hits How to Start an Invention Idea by Edwin Poul

- 10700 hits How to Download and Install Facebook Messenger on Firestick by Hope Mikaelson

- 2662 hits Brief discussion about Water by kavin prasath

- 2146 hits Importance of Proofreading While You Write an Assignment by clara

- 2092 hits Sleeping Pillow Market by Trisha Kumari

Popular Articles

In today’s competitive world, one must be knowledgeable about the latest online business that works effectively through seo services....

77514 Views

Are you caught in between seo companies introduced by a friend, researched by you, or advertised by a particular site? If that is the...

33029 Views

Walmart is being sued by a customer alleging racial discrimination. The customer who has filed a lawsuit against the retailer claims that it...

14056 Views

If you have an idea for a new product, you can start by performing a patent search. This will help you decide whether your idea could become the...

11257 Views

Statistics

| Members | |

|---|---|

| Members: | 15673 |

| Publishing | |

|---|---|

| Articles: | 64,357 |

| Categories: | 202 |

| Online | |

|---|---|

| Active Users: | 268 |

| Members: | 4 |

| Guests: | 264 |

| Bots: | 14832 |

| Visits last 24h (live): | 1787 |

| Visits last 24h (bots): | 34860 |