Before you start your profession as a property preservation company, it is essential that you have appropriate insurance to secure yourself, the property you deal with, and the one you hire. You will require both commercial liability insurance and worker’s compensation insurance at an absolute minimum. Numerous AMCs will confirm that you have these policies set up before they consent to work with you. At first, securing insurance will cost you the maximum expense.

To make the cost more agreeable, arrange a monthly installment plan, so you don’t have to hand over a lot of money forthright. Each insurance company and policy has its distinct preferences and inclinations. It is absurd to expect to audit them all inside and out here, but we will study the basics to help you while exploring insurance policies and the measure of cash that can hamper you.

General Liability Insurance

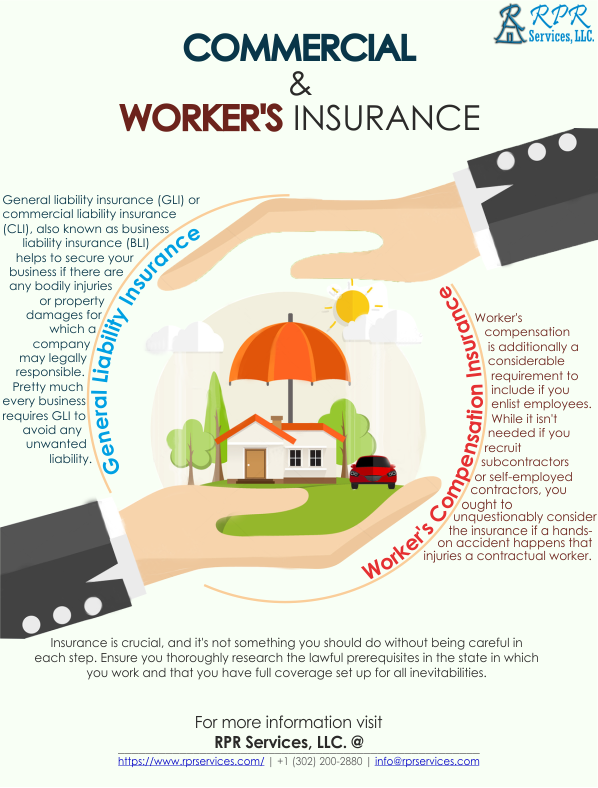

General liability insurance (GLI) or commercial liability insurance (CLI), also known as business liability insurance (BLI) helps to secure your business if there are any bodily injuries or property damages for which a company may legally responsible. Pretty much every business requires GLI to avoid any unwanted liability.

- General liability insurance: will insure you against any costs you face in the time your business or job causes injury or damage. The claims that cover the expenses include:

- 1.Any legitimate expenses you acquire for protecting yourself against a lawful or civil charge against you. These incorporate court costs, police charges, lawyer expenses, and other primary expenses

- 2.Any settlement expense that emerges from a suit filed against you.

- 3.Any interest in the judgment against you if your defense comes up short.

- 4.The medical charges of any person who was injured because of your work.

- 5.Any bonds or premiums that are required for a liability trial.

- Worker’s Compensation Insurance: Worker’s compensation is additionally a considerable requirement to include if you enlist employees. While it isn’t needed if you recruit subcontractors or self-employed contractors, you ought to unquestionably consider the insurance if a hands-on accident happens that injuries a contractual worker.Some insurance agencies offer “pay as you go” worker’s compensation insurance, where your workers’ pay premiums are determined utilizing your actual payroll numbers as opposed to a fixed or evaluated number of protected individuals.Worker’s compensation insurance or employer’s liability insurance covers any medical and disability expenses your employees may incur due to any work-related illness or injuries they encounter when they are working with you on any job.

Insurance is crucial, and it’s not something you should do without being careful in each step. Ensure you thoroughly research the lawful prerequisites in the state in which you work and that you have full coverage set up for all inevitabilities.

- Securing the Contractor’s License: If you are wiping out the house, removing debris, and making essential repairs, you won’t need any legitimate documentation.But if you are doing more intense work, primarily check the guidelines of the state wherein you are working. In certain nations, there are provisions for the handyman services that will sanction you to finish a specific work giving it falls under a pre-decided dollar amount. Although, in different areas, you will require a particular contractual worker’s license, and getting your hands on one of these can be a long way from direct.

RPR Services is a property preservation work order processing company, which provides all types of REO services like inspections QC and processing services to National, Regional, and Inspection Companies. We offer the best professional team of experts who has an innumerable experience on P&P & REO work and can render all type of property preservation updating services.

Article source: https://article-realm.com/article/Finance/7627-What-is-commercial-and-workers-insurance-in-the-property-preservation-business.html

Reviews

Comments

Most Recent Articles

- Nov 4, 2024 How Can Mutual Fund Software Help MFDs Find Common Stocks Between Two Schemes? by Wealth Elite

- Oct 28, 2024 What Are the Best Features of a Mutual Fund Software in India? by Wealth Elite

- Oct 23, 2024 Why Women Investors Need a Financial Planning Consultant in Mumbai? by Chamunda Investment Services LLP

- Oct 21, 2024 How Does Mutual Fund Software Help in Planning Education Investments for Investors? by Wealth Elite

- Oct 11, 2024 How Does Mutual Fund Software in India Help in Planning Regular Income with SWP Calculator? by Wealth Elite

Most Viewed Articles

- 11257 hits How to Start an Invention Idea by Edwin Poul

- 10700 hits How to Download and Install Facebook Messenger on Firestick by Hope Mikaelson

- 2662 hits Brief discussion about Water by kavin prasath

- 2146 hits Importance of Proofreading While You Write an Assignment by clara

- 2092 hits Sleeping Pillow Market by Trisha Kumari

Popular Articles

In today’s competitive world, one must be knowledgeable about the latest online business that works effectively through seo services....

77514 Views

Are you caught in between seo companies introduced by a friend, researched by you, or advertised by a particular site? If that is the...

33029 Views

Walmart is being sued by a customer alleging racial discrimination. The customer who has filed a lawsuit against the retailer claims that it...

14056 Views

If you have an idea for a new product, you can start by performing a patent search. This will help you decide whether your idea could become the...

11257 Views

Statistics

| Members | |

|---|---|

| Members: | 15673 |

| Publishing | |

|---|---|

| Articles: | 64,357 |

| Categories: | 202 |

| Online | |

|---|---|

| Active Users: | 269 |

| Members: | 4 |

| Guests: | 265 |

| Bots: | 16302 |

| Visits last 24h (live): | 1655 |

| Visits last 24h (bots): | 35813 |